In today’s fast-paced digital world, our online presence and digital assets play an ever-increasing role in our lives. From social media profiles to online banking, digital photo albums to personal blogs, our online footprint represents an extension of our lives and identity. As such, it’s essential to consider the management and preservation of our digital estate alongside traditional estate planning endeavours. If someone had to make sense of your digital affairs without your help, would they know what accounts you held, where you stored your digital photos, or how to access your email?

This comprehensive guide will delve into the critical aspects of digital estate planning, ensuring that your online assets and digital legacy are properly managed, secured, and preserved after your passing or incapacity. We will discuss the types of digital assets you should include in your plan, the importance of appointing a digital executor, and the necessary steps to take for outlining your preferences and safeguarding your digital accounts and information.

Embracing the complexities of digital estate planning is essential for a comprehensive approach to getting your affairs in order. By taking proactive measures to protect your digital assets, communicate your wishes, and provide clear guidance for your digital executor, you can ensure that your online presence is effectively managed and your digital legacy continues to thrive even after you are no longer able to manage it personally. Remain one step ahead and navigate the digital realm with confidence, as you craft a thoughtful and thorough plan for your digital estate.

Identifying Your Digital Assets: An Inclusive Approach

Financial Accounts: Keep a well-organized list of your online banking, investment, and credit card accounts, including the account numbers and online login credentials required to access them. This information will ensure that your digital executor or estate trustee can manage these assets efficiently.

- Social Media Profiles and Email: Document your social media accounts, blogs, and email platforms, providing the necessary login details to manage, deactivate, or archive these accounts according to your wishes.

- Digital Media Collections: Compile a list of digital media files you own, such as eBooks, photos, videos, or music. Ensure that your digital executor is aware of the storage location, file formats, and any copyright or licensing restrictions for these files.

- Subscription Services and Online Shopping: Detail any paid subscription services and online shopping platforms you use, providing your account credentials, payment information, and subscription preferences.

Appointing a Digital Executor: Managing Your Digital Estate

- Who to Choose: Select a trusted individual who is tech-savvy, reliable, and willing to manage your digital assets according to your wishes. This individual may be the same person designated as your estate trustee, or it may be someone else with the appropriate technical skills.

- Legal Considerations: Consult an estate planning attorney to determine the appropriate legal methods for appointing a digital executor in your jurisdiction. Depending on the specific Canadian federal and provincial laws, you may need to incorporate this appointment into your will or other estate planning documents.

Outlining Your Preferences: Communication is Key

- Detail Your Wishes: In a separate document or incorporated into your will, provide clear instructions related to each category of your digital assets. Specify your preferences for the management, distribution, deletion, or memorialization of these assets and accounts.

- Confidential Storage: Ensure that your account information, accompanied by a thorough explanation of your digital wishes, is stored securely in a safe and confidential location, such as an encrypted digital vault or a physically secured document.

- Ongoing Updates: Periodically revise and update your compiled digital accounts and preferences, ensuring that your digital estate plan remains current and accurate over time.

Digital Estate Planning Best Practices: Securing Your Online Domain

- Privacy and Passwords: Implement strong, unique passwords for each of your digital accounts. Consider using a password manager to store your credentials securely, providing your digital executor with access to the password manager’s “emergency contact” or “legacy contact” features.

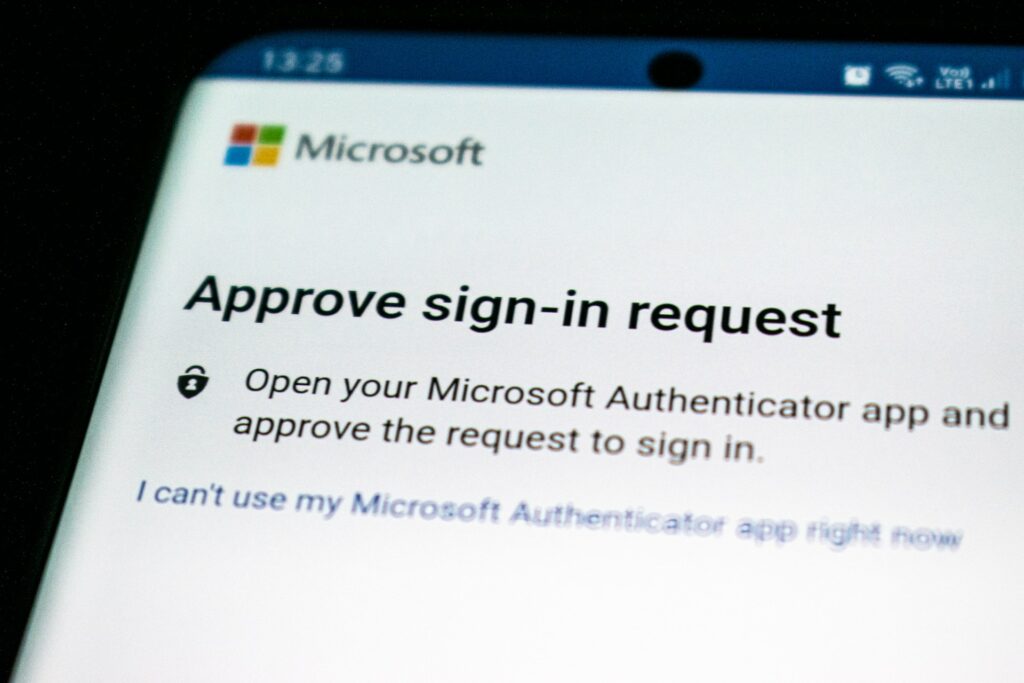

- Two-Factor Authentication: Where possible, enable two-factor authentication for your online accounts. Keep your digital executor informed of any changes in your authentication methods and backup recovery processes.

- Be Aware of Terms of Service: Review the terms of service for any digital platforms or services you use, understanding any restrictions related to the transfer, deletion, or management of your accounts after your death or incapacity. This information will help your digital executor make informed decisions when managing your digital assets.

- Consult with Professionals: Collaborate with legal and estate planning professionals to understand your rights and responsibilities related to digital estate planning. These experts can help guide you through the complex digital landscape and ensure your plan complies with Canadian federal and provincial legislation.

Conclusion

Incorporating a digital estate plan into your comprehensive approach to getting your affairs in order is essential for today’s increasingly connected world. By proactively identifying your digital assets, appointing a knowledgeable digital executor, and outlining your preferences for managing these accounts, you can secure and preserve your online assets and digital legacy for future generations.

As your online presence continues to grow and evolve, ensuring that your digital estate and digital legacy are managed with the same thoughtful attention as your traditional assets allows you and your loved ones to navigate the digital realm with confidence and peace of mind.

Optimizing your digital estate plan requires careful consideration, expert guidance, and ongoing communication with your digital executor and legal professionals. That’s why at Getting Your Affairs in Order, we offer comprehensive estate planning documentation services that take into account your digital assets and provide guidance on how to manage them in the event of your incapacity or death. Let us ensure that your online assets are protected and preserved for years to come. Contact us today to schedule an appointment!